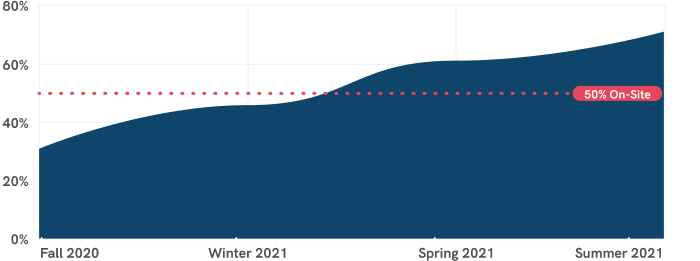

Employers are adopting a phased approach to reopening, but many remain uncertain. This fall, about one-third of the region’s workforce is expected to physically return to worksites.

Capital COVID-19 Snapshot:

Safe Return to Work

We encourage Capital Region employers to answer our 10-min Capital COVID Survey: Planning for the Return to Worksites by December 11, 2020. Your input will help us to provide an updated snapshot on the state of the Capital Region’s reopening plans & factors around other strategies that most influence employer decisions. Take the Survey »

Bringing people, organizations, and jurisdictions together to make the Capital Region of Baltimore, Washington, and Richmond, the world’s best place to live, work, raise a family, and build a business. The Capital COVID-19 Snapshot: Return to Work survey and transit tracker, conducted in partnership with public agencies and business organizations throughout the region, is designed to increase regional information and data sharing so employers, both large and small, can make more informed decisions about reopening, and public agencies can better understand when employees are expected to return to their offices and worksites.

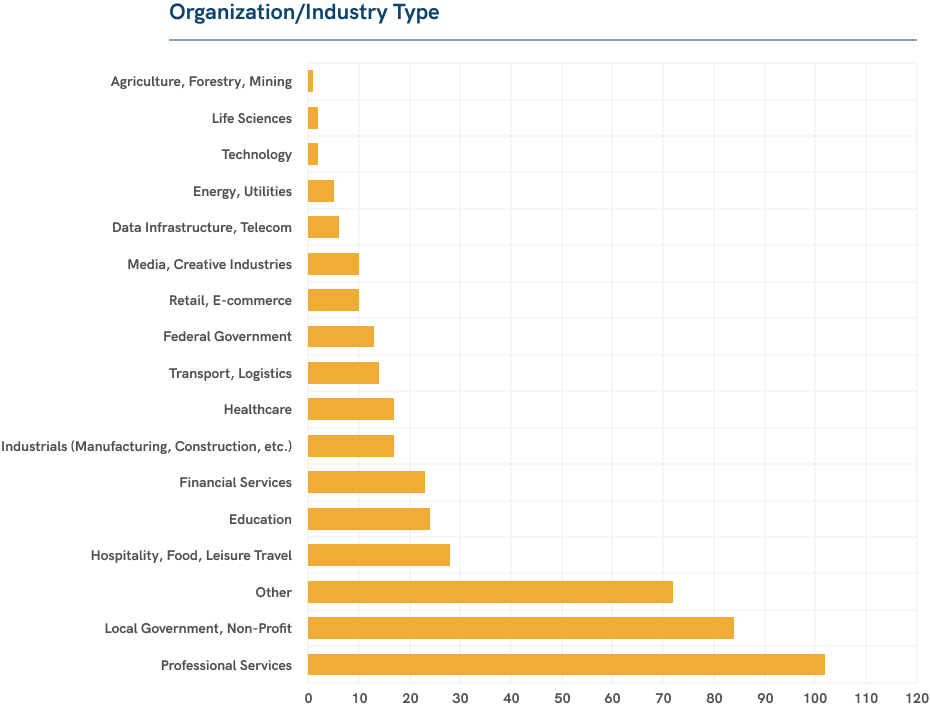

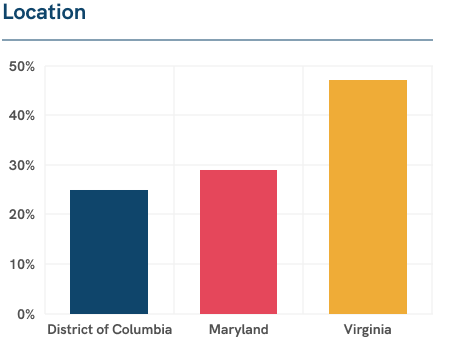

The Capital COVID-19 Survey was conducted between August 10-28, 2020, with more than 430 unique employers participating from the Washington, Baltimore, and Richmond metro areas that employ 275,000 residents. Along with an analysis of employer reopening plans, this report includes public sector information, a Transit Tracker that provides ridership trends and the social distancing carrying capacity of the region's public transportation systems. The findings contained in this report will help employers and public agencies collaboratively reopen the Capital Region's economy safely, gradually and sustainably in the months ahead. The Partnership intends to update this product regularly as the region continues to reopen, so that all decision-makers and residents have access to regular, timely and actionable advice. As we work together to reopen the region safely, The Partnership encourages all employers and residents to do their part to help slow the spread of COVID-19 by following public health officials' guidance, wearing masks and observing social distancing guidelines.

Employers are adopting a phased approach to reopening, but many remain uncertain. This fall, about one-third of the region’s workforce is expected to physically return to worksites.

Of employers who had long-term reopening plans, on average, those employers expect to have 72% of their employees return to the office by Summer 2021. However, a third of responding employers are still unsure of their summer 2021 plans.

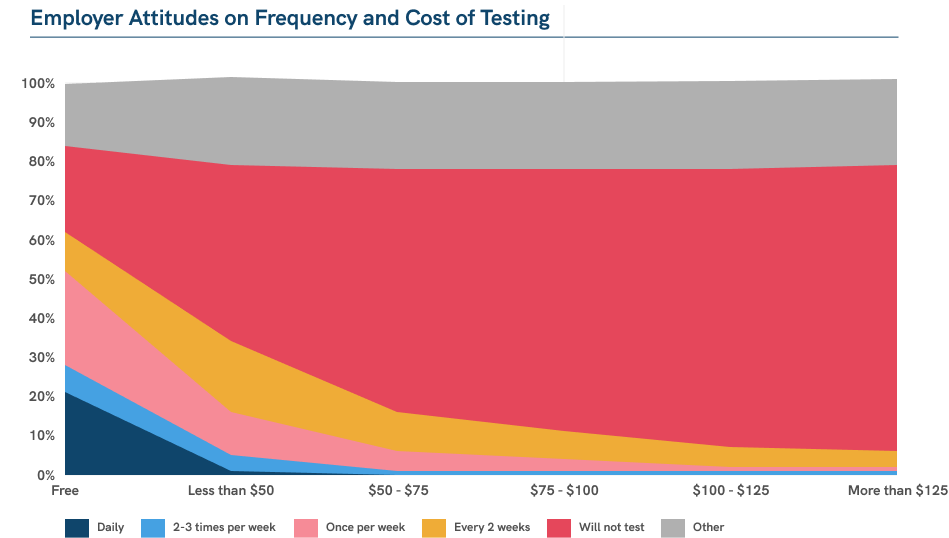

Most employers want to regularly test their employees for COVID but will not if the test costs more than $50.

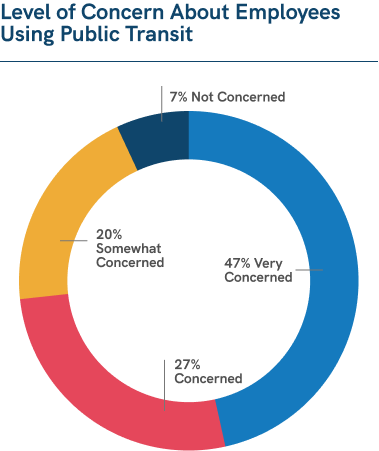

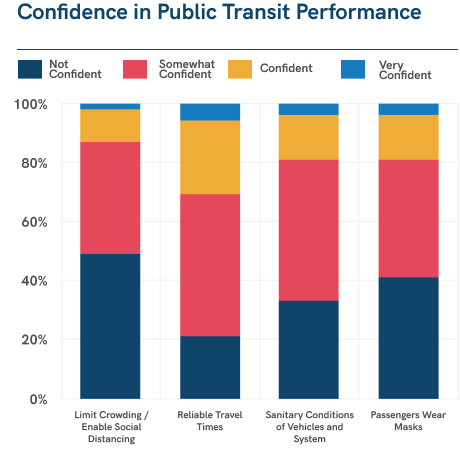

Nearly half of employers indicated a high level of concern about public transit safety and a low level of confidence that public agencies can control crowding and enforce the wearing of masks.

Metrorail ridership remains well below historic levels (85% below last year) while service, hours of operation, and frequencies are close to pre-pandemic levels, resulting in no Metro lines exceeding the social distance crowding standards on average in August, during peak periods.

Local and WMATA bus transit services generally reported smaller ridership declines compared to commuter rail and bus, but no transit agencies have reported widespread crowding issues as of August.

Some historically high-ridership bus routes are experiencing crowding above social distancing capacity at certain times of day; a standard 40ft bus has about 40 seats, but the CDC guidance on social distancing capacity limits capacity to only 10 passengers.

While crowding on the transit system is not common today, budget challenges resulting from COVID-19 will exacerbate crowding concerns should Congress be unable to provide additional aid to our region’s transit network, which is expected to lead to service reductions.

The Greater Washington Partnership is most successful when aligned with our exceptional partners throughout the Capital Region. Thank you to the following partners for collaborating on this effort to ensure the Capital Region has a strong, safe recovery.

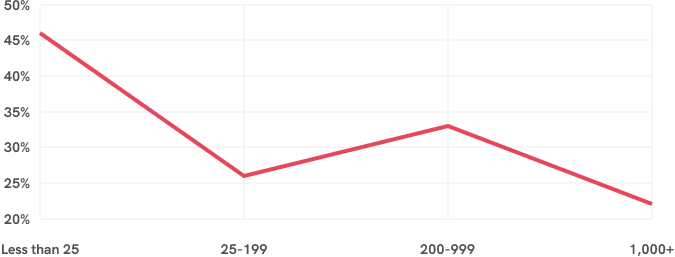

Based on responses as of August 2020, more than 60% of employers plan for less than one third of all employees returning to worksites post Labor Day, with nearly 20% with no employees returning. Of the employers with plans, on average, just 72 percent of their employees are expected to return to the office by summer 2021. However, a third of responding employers are still unsure of their summer 2021 plans.

Decision-makers must continue to prioritize the health and safety of workers, and their families. By collecting and widely disseminating this information, leaders across organizations will be able to learn from each other and apply best practices to their operations.

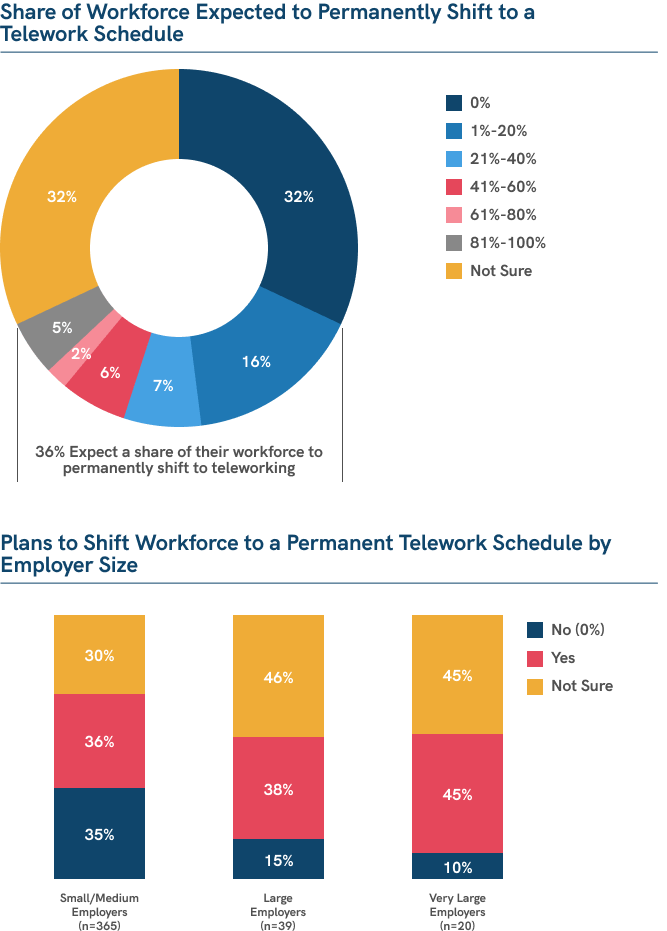

Although 33% of responding employers remain unsure about shifting their workforces to permanent telework schedules, close to 50% of those with a plan said they expect at least 10% of their workforce to telework permanently.

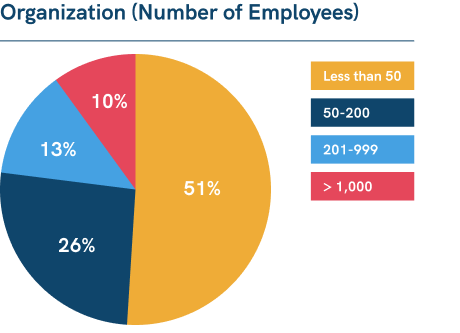

Large organizations, those with more than 5,000 employees are more likely to favor permanent telework schedules - while many remain unsure only 10% do not have definitive plans for permanent shifts towards teleworking.

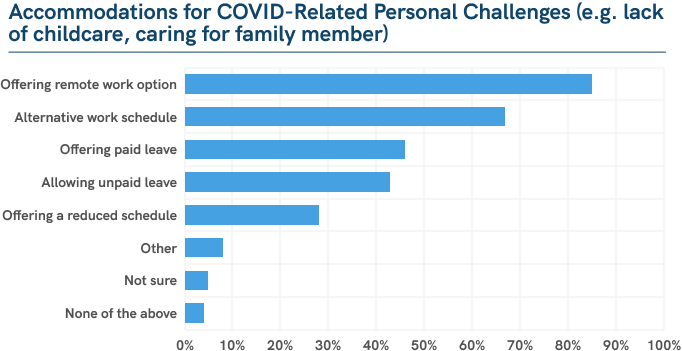

Employers are implementing revised policies and procedures to promote the safety and well-being of employees and their families during this pandemic, with a majority offering flexible and remote work options, and/or paid or unpaid leave. Comments from employers indicated the new accommodations are heavily influenced by employee childcare and education needs.

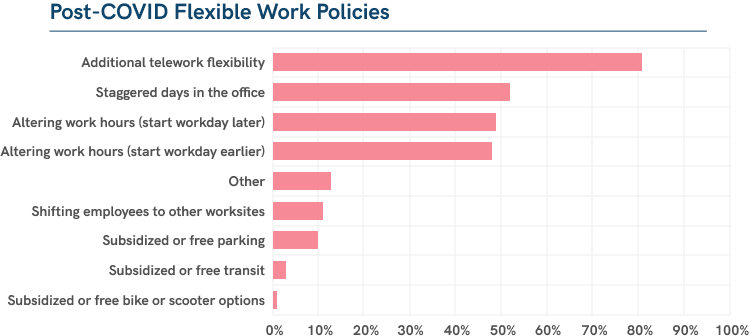

In addition to allowing more telework, over half of employers responding to the survey are changing existing schedules to accommodate employee needs and ensure safety protocols. In addition to the listed options, employers noted that they are also providing expanded employee assistance programs, access to additional resources for working parents, and providing childcare at their worksites.

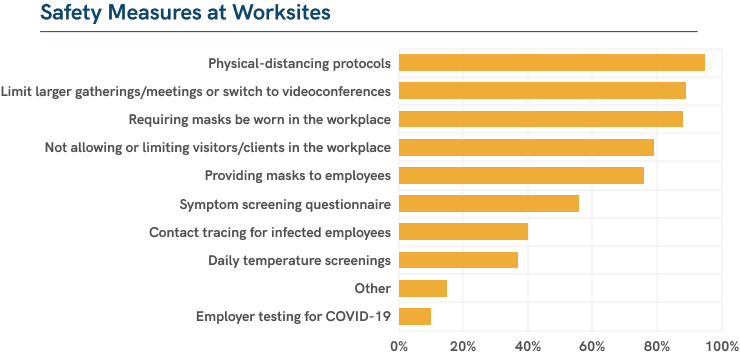

Employers are actively working to mitigate the risk of viral spread by adjusting their procedures for those employees that do return to worksites. Four-in-ten employers plan to conduct contact tracing for infected employees but only one in ten expects to test their employees for COVID-19.

A robust regionwide testing strategy that is timely, accessible, and affordable is needed to achieve our shared goal of reopening safely and sustainably. In addition to a robust testing strategy, there is a suite of actions employers are adopting to lower the transmission risk further. These include social distancing, contact tracing and requiring masks.

While the Capital Region has been ramping up testing, there is no coordinated strategy or best practices for employers. A robust regionwide testing strategy that is timely, accessible, and affordable is needed to achieve our shared goal of reopening safely and sustainably. In addition to a robust testing strategy, there is a suite of actions employers are adopting to lower the transmission risk further. These include social distancing, contact tracing and requiring masks.

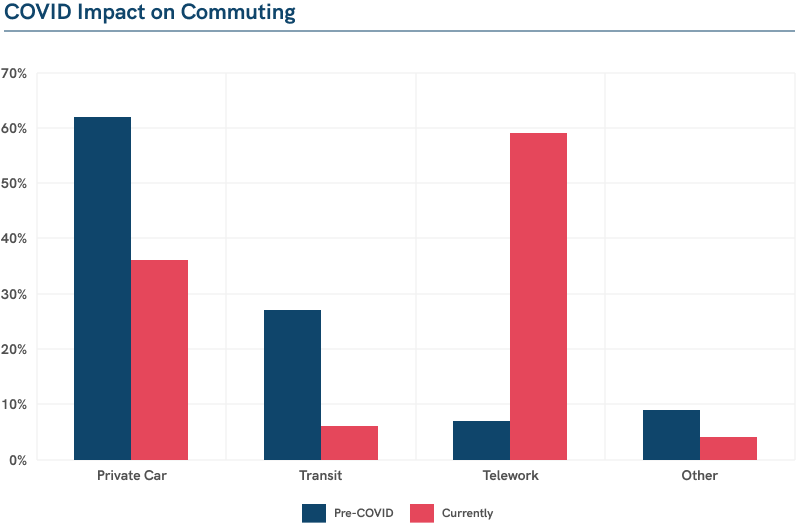

Teleworking use has grown more than 7x since February, while transit use has shrunk by 4x. The pandemic is likely to have long-lasting impacts on how employees commute to their worksites, but the full impacts may not be felt for many months.

We know that the region’s transit system will be critical to reopening the Capital Region's economy safely and sustainably once we are ready.

As more businesses reopen and more employees return to worksites, employers are very concerned about transit’s ability to safely transport employees to worksites. The top concerns reported by employers were fear of crowding and whether riders will wear masks (as of August 2020, nearly all transit agencies in the Capital Region are requiring masks be worn on transit and are not reporting significant capacity issues that exceed social distancing capacity).

Working in partnership with the region’s transit operators through the Metropolitan Washington Council of Governments (MWCOG), WMATA’s public datasets and with expert guidance from Metro Hero, the Greater Washington Partnership and EY have created the Capital COVID-19 Transit Tracker. The tracker is intended to help employers and employees make decisions about whether and how to safely use transit. The tool allows the region to better understand the ridership and capacity limitations of the WMATA Metrorail System and provides summaries of service from commuter rail and bus transit providers around the region.

The top concerns reported by employers were fear of crowding and whether riders will wear masks (as of August 2020, nearly all transit agencies in the Capital Region are requiring masks be worn on transit and are not reporting significant capacity issues that exceed social distancing capacity). Data included in the report pertains to August 2020 and is subject to change based on the state of the health crisis and its impact on public budgets and transit agency service levels.

* The Transit Tracker will be updated as data is made available—estimate twice per month for Metrorail data and every other month for the other systems.

Employers are concerned with transit’s ability to safely transport employees to worksites due to crowding and face mask concerns. Real-time ridership numbers, reporting on social distance carrying capacity, crowding data, and information on mask compliance may help employers and employees feel more confident in using the transit network during the COVID pandemic.

Many of the Capital Region’s employers are uncertain when and how to reopen and whether transit is safe for their employees. While employers and public agencies are taking unprecedented steps to make their worksites and transit trips safer, the full return to worksites is not expected for at least a year. The Greater Washington Partnership’s aim for the COVID-19 Survey, the cross-sector information sharing and the Transit Tracker tool, is to provide the region’s leaders and public sector officials with actionable information to enable them to better address the uncertainty in planning for the reopening of their worksites and the Capital Region in a safe, gradual, and sustainable manner.

The Greater Washington Partnership sends a special thanks to our front-line workforce that are keeping the region safe during this global health pandemic. We also thank our public and private sector partners, especially the transit agencies, business organizations, and individual employers who helped to disseminate the survey and share their data. We encourage everyone to do their part by wearing masks, social distancing, and adhering to the guidance of public health officials. We look forward to continuing to work together to share more relevant and timely information so we can make the Capital Region one of the best places to live, work, and build a business during and after the COVID-19 pandemic.

430 employers (562 worksites) from various industries are represented in the survey. Together these organizations employ more than 275k people in the Capital Region (full time, part-time and contracted workforce).